The cryptocurrency market has faced a sobering period of correction in late 2025, as the initial euphoria of the post-halving cycle gave way to significant volatility and a notable decoupling from traditional equities. In fact, a close friend who avoided investing in cryptocurrencies for years decided to read my book, Blockchain or Die, and in early 2025, invested in a top ten cryptocurrency by market capitalization. In mid-December, she called me and asked: “what’s up with crypto? My crypto is down almost 50%”. Then she went on to compare her crypto to her 401K, which is NASDAQ/tech heavy, and pointed out her 401K is out-performing her crypto. All accurate and valid points. I reminded her that we are both long term investors and we can buy and hold to weather market down-turns. I also pointed out that this may be a good buying opportunity to buy more crypto at a discount, which would increase her return on investment. This conversation comforted her and gave her an investment plan going forward, but it also gave me the idea for another article in advance of the release of my next book: Blockchain or Die Harder.

Bitcoin v. NASDAQ: The New Versus the Established

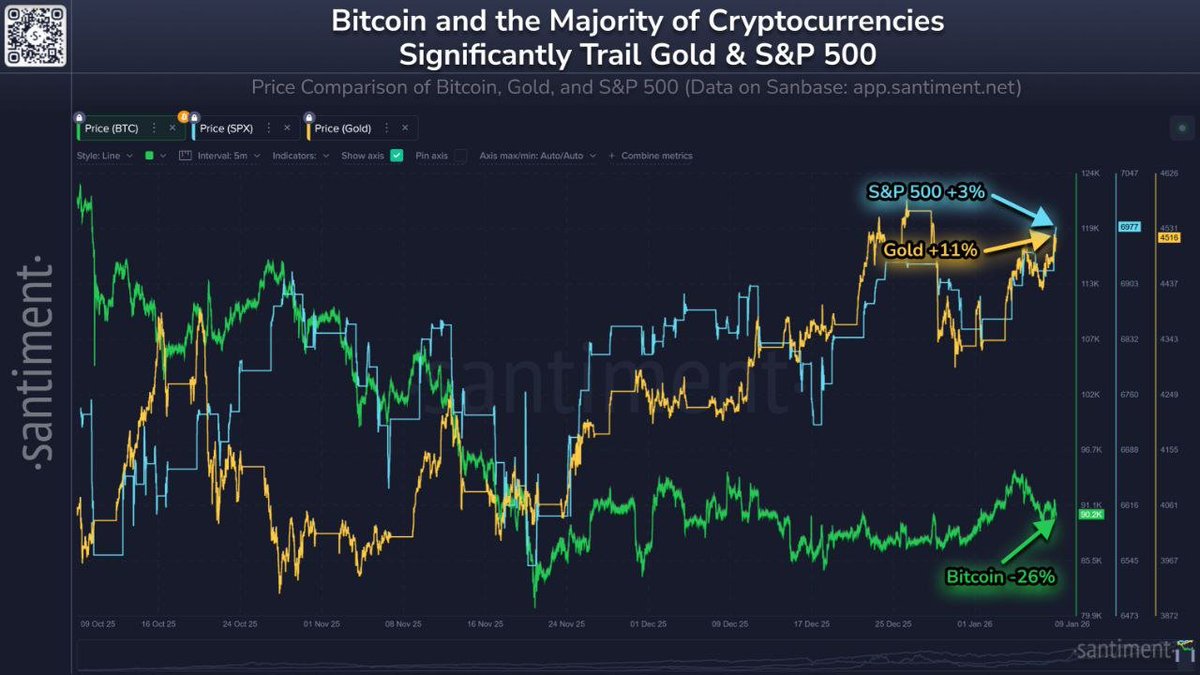

Bitcoin was all the rage when it reached an all-time high of $126,000 in October 2025, but as of December 2025, Bitcoin has dropped to $88,000. In contrast, the NASDAQ has shown greater resilience; despite recent bearish reversals and macro-economic pressures like rising interest rates, it has largely outperformed the flagship digital asset over the same period. This divergence highlights a “risk-off” sentiment where investors are retreating from the high-beta volatility of crypto in favor of more established tech stocks, leaving Bitcoin traders to navigate a landscape where the traditional correlation with Wall Street’s “bull runs” appears to have fractured.

The Negative Impact of Worthless Coins on the Crypto Market

The internal health of the crypto ecosystem is further strained by an overwhelming proliferation of “worthless” or poorly conceived digital assets. The number of new coins has increased at an exponential rate—with data now suggesting that over 50 million unique tokens or smart contracts exist across various blockchains, though fewer than 11,000 maintain any significant trading activity. This flood of low-utility tokens, particularly “memecoins” and experimental assets on high-speed networks, has diluted the market’s total liquidity and created a “noise” problem. For potential new investors, the sheer volume of “garbage” coins makes it nearly impossible to distinguish legitimate innovation from speculative traps, effectively discouraging the entry of new capital that the market desperately needs to sustain growth.

Scammers Strip Away the Promise of Crypto to Many Investors

Compounding this sense of hesitation is the persistent shadow of financial crime, which continues to erode the industry’s credibility. Scammers have stolen an estimated $3.4 billion in 2025 alone, utilizing increasingly sophisticated tactics such as AI-driven deepfakes, “pig butchering” schemes, and massive “rug pulls.” These incidents do more than just cause immediate financial loss; they create a lasting psychological barrier. When nearly 40% of current crypto owners express a lack of confidence in the security of the technology, it is unsurprising that “fear of fraud” remains the primary reason cited by non-investors for staying on the sidelines. The negative impact of these bad actors on prices is profound, as the resulting lack of trust prevents the market from reaching the mass adoption required for long-term stability. The impact on scammers is so important to the crypto market, that I dedicated an entire chapter to cryptocurrency, NFT and metaverse scams in Blockchain or Die Harder where I provide many recommendations on protecting yourself against cryptocurrency scams.

The Answer: Crypto Quality Not Crypto Quantity

For the cryptocurrency industry to remain competitive, credible, and viable in the global financial system, a period of rigorous consolidation is now essential. The current saturation of thousands of redundant companies and millions of dead tokens is unsustainable. Market experts suggest that a “great thinning” is necessary—one where legitimate digital asset firms integrate and weak, speculative projects are allowed to fail. This consolidation would allow the sector to shift its focus from reckless speculation to strategic financial engineering and utility-driven innovation. Only through such a restructuring can the market provide the transparency and safety required to attract institutional-grade investment and prove that it is a maturing asset class rather than a playground for volatility and fraud.

Summary

That being said, 2026 will be a pivotal year for cryptocurrencies. If we are faced with another prolonged crypto-winter, or at least a 2026 bear market, a number of worthless cryptocurrencies will go out of business; thus, in theory, reducing the number of worthless cryptocurrencies. This will leave a more credible and fundamentally solid cryptocurrencies for investment. But the key for individual success in for cryptocurrency investors to thoroughly research cryptocurrencies and educate themselves. For example, all of the major topics in this article are addressed in detail in Blockchain or Die Harder. So when Blockchain or Die Harder comes out in the winter of 2026, be sure to pick up a copy or attend one of my speeches and book signings.

Thank you and Happy Holidays!

Eric Guthrie, Esq